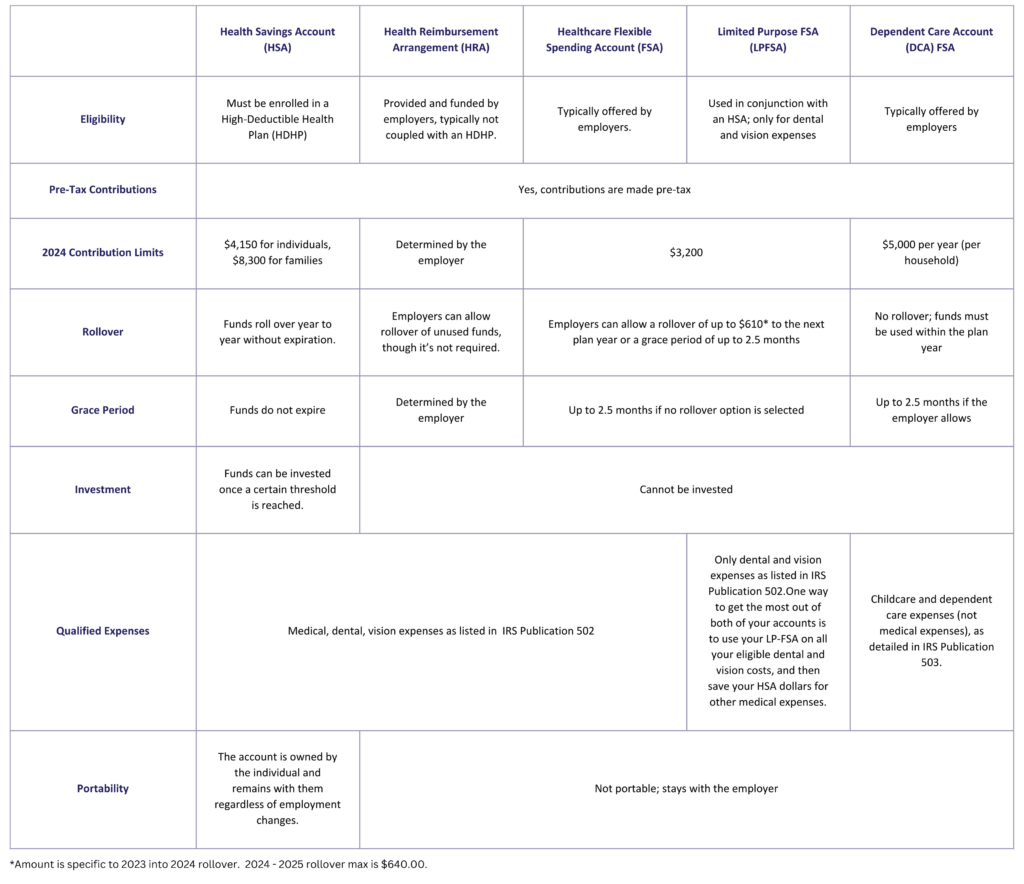

Health Savings Accounts (HSAs), Health Reimbursement Arrangements (HRAs), Flexible Spending Accounts (FSAs), Limited Purpose FSAs (LPFSAs), and Dependent Care Accounts (DCAs) are all tools that allow employees to use pre-tax dollars for medical expenses. Although there may be similarities between them, HSAs, HRAs, and FSAs are different from one another, and each one has distinct benefits for you and your employees. Below is an overview of each:

Health Savings Account (HSA)

HSAs are an elective benefit that an employer can offer as a way for employees to set aside tax-advantaged medical savings to pay for copays, deductibles, and other eligible medical expenses, including dental and vision care. HSAs are a suitable option for healthy employees who generally receive medical care for predictable, annual checkups and have infrequent medical needs.

Employees covered by Medicare are not eligible to contribute to an HSA.

Health Reimbursement Arrangement (HRA)

A health reimbursement arrangement is an employer-funded plan that supplements health insurance benefits and pays for a range of qualified medical expenses not covered by insurance. HRAs are among the most flexible types of employee benefits plans. Unlike an HSA or FSA, employees cannot contribute to an HRA. An HRA is advantageous for all employees.

HRAs can reimburse Medicare premiums, and employees can use HRA funds to cover medical expenses for spouses and dependents.

Flexible Spending Accounts

An FSA is an employer-established plan that pays for qualified medical expenses with pretax dollars. There are three different types of FSA’s. Below is an overview of each.

Health Care Flexible Spending Account (FSA)

A Health Care FSA (HCFSA) is a pre-tax benefit account that’s used to pay for eligible medical, dental, and vision care expenses that are not covered by your health care plan or elsewhere. With an HCFSA, you use pre-tax dollars to pay for qualified out-of-pocket health care expenses.

Limited Purpose FSA (LPFSA)

Limited-Purpose FSAs are a tax-advantaged savings account that lets you set aside pre-tax money to pay for eligible dental and vision expenses. LP-FSAs can cover individuals, spouses, and eligible dependents.

Dependent Care Account (DCA) FSA

A dependent care FSA is an employer-sponsored benefit that helps employees manage expenses associated with caring for a qualified dependent, such as a child (age 12 and under) or incapacitated family member. Employees who enroll in a dependent care FSA contribute a portion of their compensation to cover the cost of dependent care services necessary for them to work. Their employer deducts these contributions via pretax payroll deductions.

Click here to read more from the BSI blog, Wise & Well.

Learn more about BSI Corporate Benefits here.